Introduction

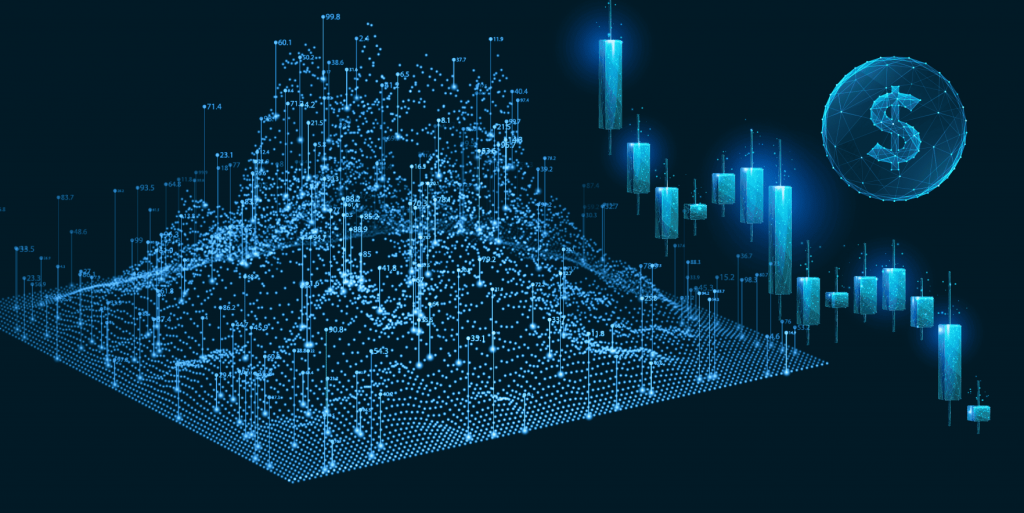

Banks and financial institutions operate in one of the most volatile environments in business. Markets fluctuate daily, consumer behavior shifts rapidly and fraud grows more sophisticated every quarter. Traditional risk models cannot respond fast enough. Big data in finance changes the equation. Instead of reacting to problems after they occur, institutions predict them in advance.

Financial organizations that invest in data ecosystems outperform competitors. They analyze customer profiles in real time, evaluate loan applicants more accurately and detect suspicious transactions before losses occur. Big data moves risk management from intuition to mathematics, from hindsight to foresight.

5

Why Big Data Matters in Risk Prediction

Risk is a probability puzzle. The more information an institution has, the more accurately it can predict outcomes. Big data multiplies the number of variables available for modeling. Traditional underwriting relied on income and credit history. Modern analytics incorporates digital behavior, spending patterns, employment volatility, device identification and real time market signals.

When multiple data streams converge, models become sharper. Banks no longer ask whether a borrower feels risky. They calculate how risk will evolve hour by hour.

Use Case 1: Credit Risk Prediction

Credit risk defines how likely a customer is to default. Banks now use machine learning to assess profiles with greater precision than manual review. They combine

- Payment history

- Account activity

- Income patterns

- Employment stability

- Spending categories

- Behavioral signals such as overdraft frequency

Models score borrowers on probability rather than intuition. This reduces loan losses and increases approval accuracy.

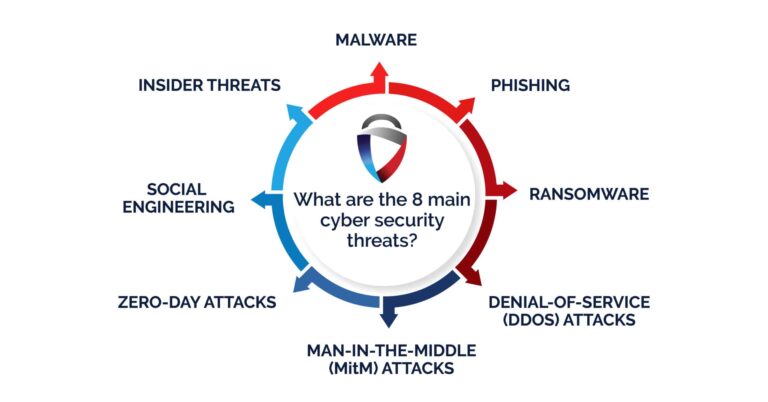

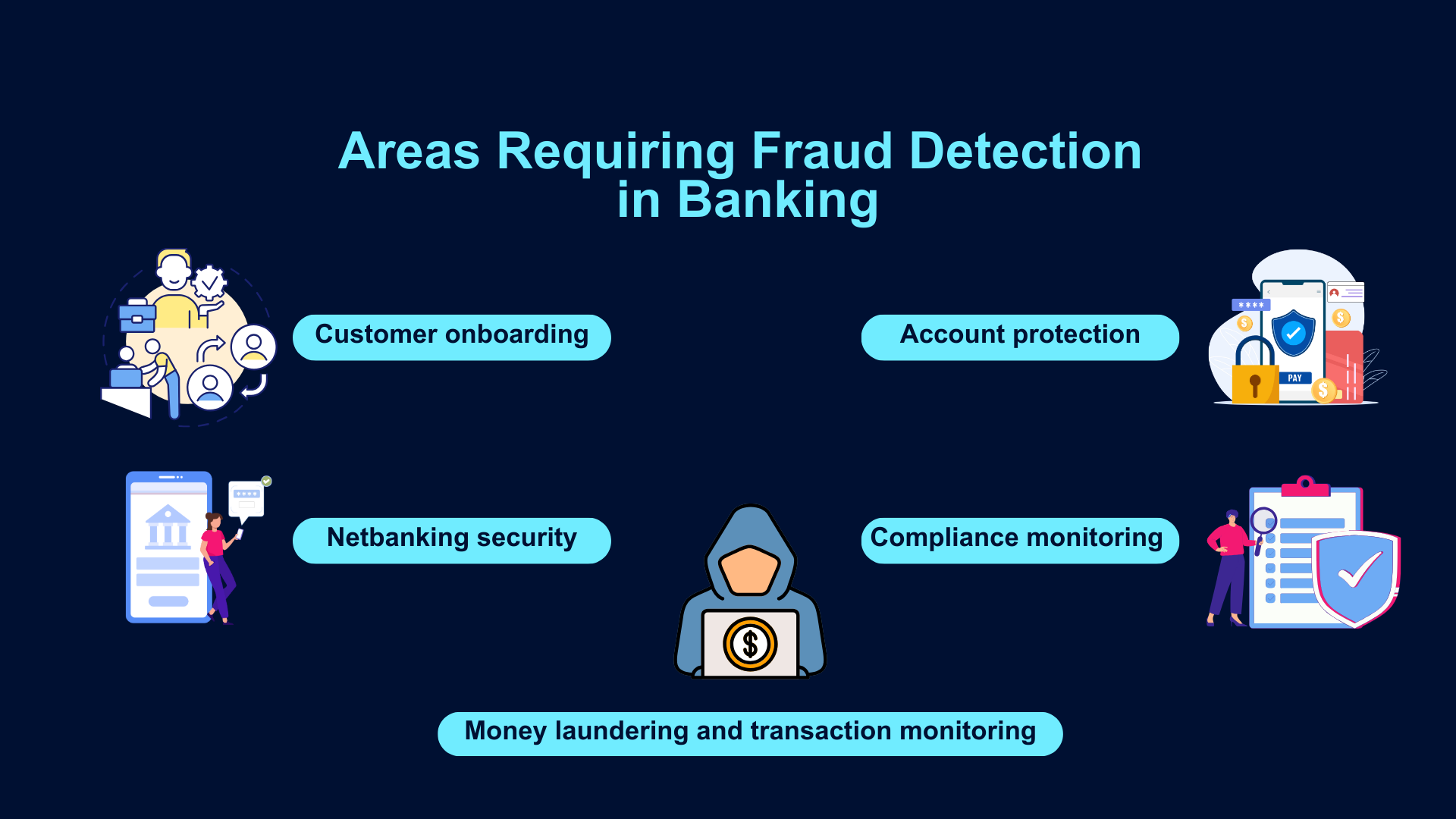

Use Case 2: Fraud Detection in Real Time

Fraud evolves faster than policy manuals. Banks rely on streaming analytics that monitor transaction behavior continuously. Algorithms evaluate

- Location anomalies

- Sudden spending shifts

- Device fingerprint mismatches

- Velocity of transaction attempts

- High risk merchant categories

When risk spikes, the system acts before humans. Cards freeze automatically. Alerts go to customers and fraud teams. Hours of investigation become seconds of prevention.

Use Case 3: Market Volatility Management

Trading desks monitor datasets that move too fast for analysts to track manually.

They extract signals from

- News sentiment

- Social chatter

- Price movements

- Economic indicators

- High frequency trading patterns

These signals inform portfolio adjustments before losses compound. Big data gives traders the advantage of anticipation, allowing action before markets fully react.

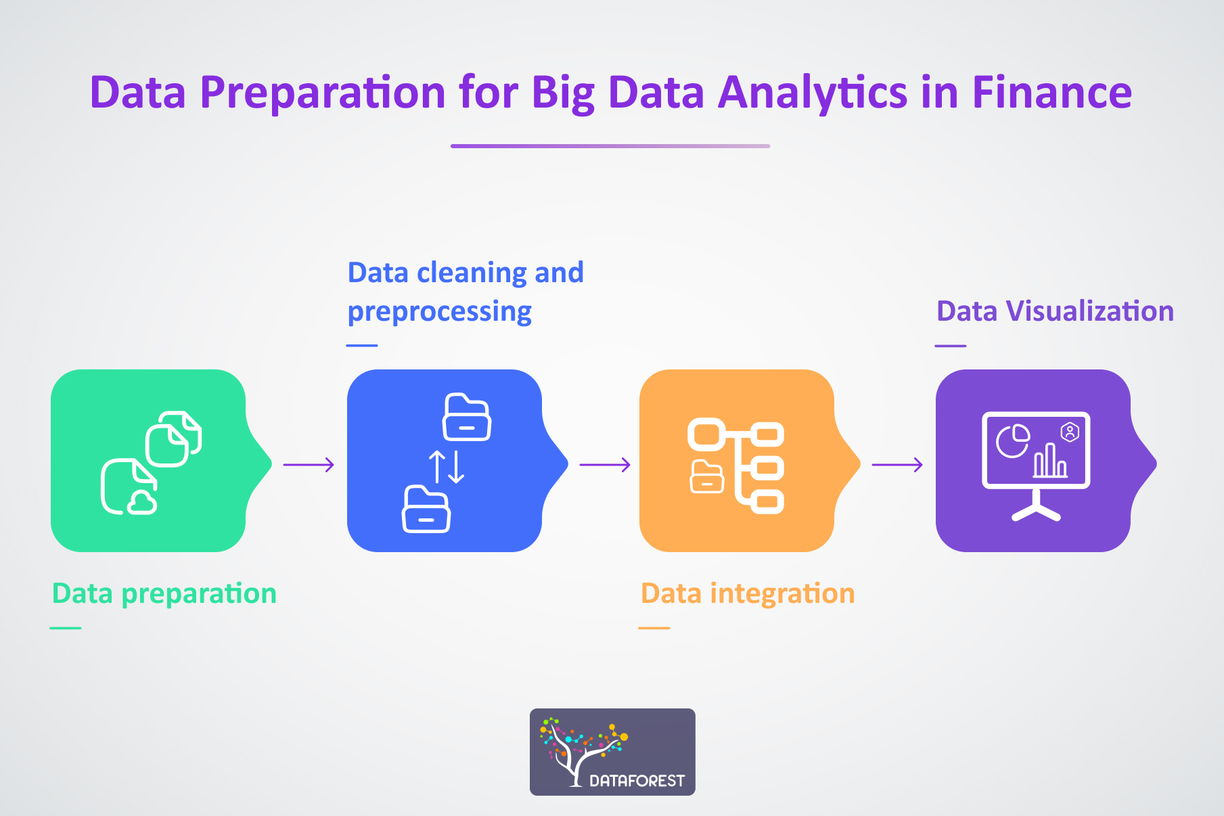

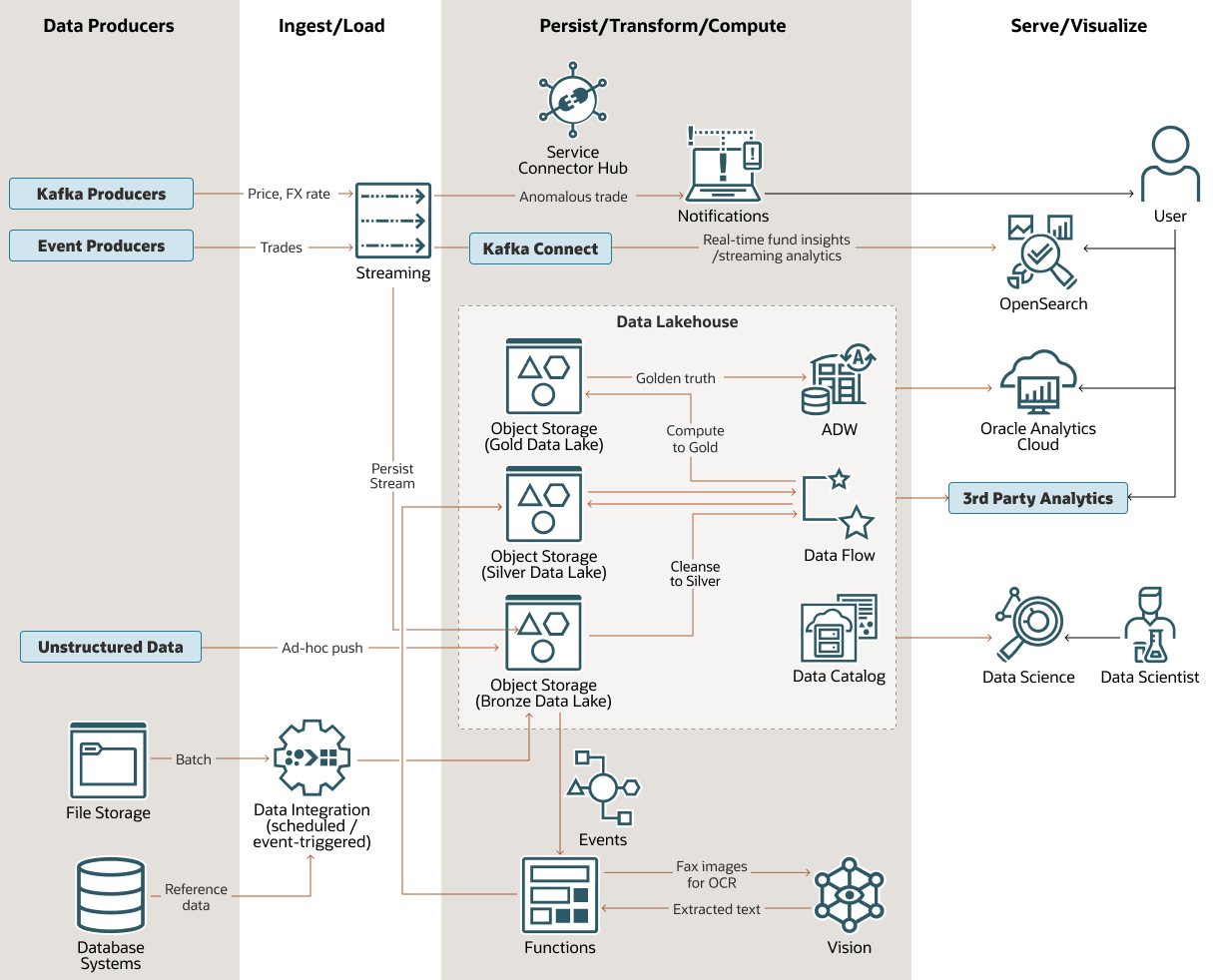

How Data Ecosystems Enable Financial Prediction

Institutions cannot deploy advanced analytics with fragmented infrastructure.

Risk prediction requires ecosystems designed to support scale, automation and compliance.

A finance ready ecosystem includes

- Secure ingestion platforms for transactional streams

- Unified storage such as a lakehouse or enterprise warehouse

- AI and ML processing frameworks

- Role based access and audit logs

- Monitoring systems for pipeline health

Executives can explore architecture and modernization at

https://dataguruanalytics.org/data-infrastructure-consulting

5

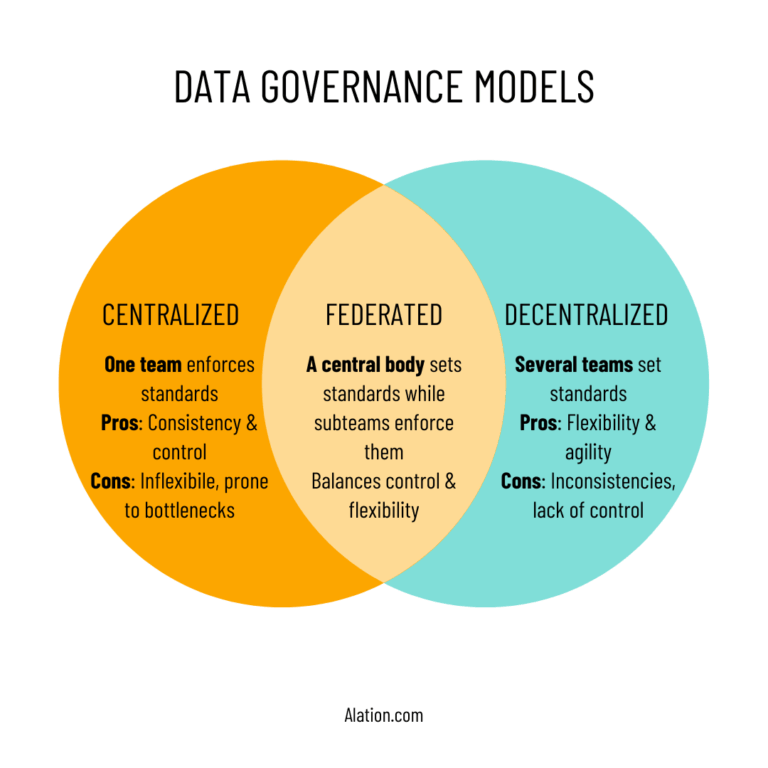

Why Governance Is Critical in Financial Analytics

Financial risk models fail when data definitions are inconsistent. No risk team can operate effectively when departments calculate basic measures differently.

Governance ensures

- One definition of every KPI

- Traceability from transaction to model output

- Compliance with regulatory benchmarks

- Ethical use of consumer information

- Consistency in portfolio scoring

Banks that treat governance as a nuisance lose credibility. Those that treat it as infrastructure gain stability and regulatory trust. Explore validation and standardization at

https://dataguruanalytics.org/data-quality-validation-solutions

AI’s Role in Institutional Risk

Artificial intelligence does not simply accelerate analytics. It discovers patterns humans cannot see.

AI models identify

- Transaction clusters

- Hidden correlations in spending

- Cross account anomalies

- Vendor based fraud networks

- Seasonality in default risk

When trained on regulated and high quality data, AI becomes a strategic weapon in fraud reduction and portfolio optimization. When trained poorly, it becomes a liability.

That is why leaders must manage training datasets with the same rigor as loan agreements.

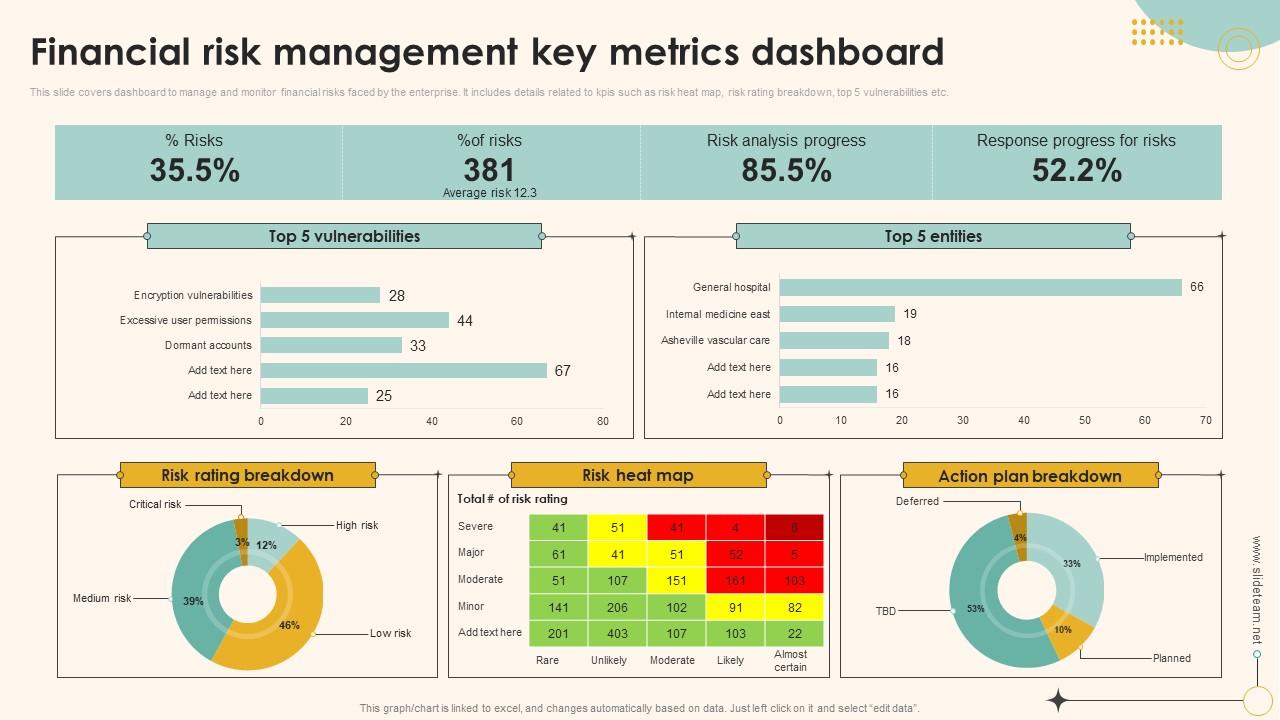

Case Study: Lending Transformation

A regional bank with rising non performing loans modernized its risk ecosystem. The institution merged transactional data, customer service logs and behavioral signals into a single analytics platform. Models examined 120 variables per applicant rather than six.

Within eighteen months

- Approval accuracy increased

- Defaults declined

- Customer retention improved

- Operational review time fell by half

The bank did not get smarter overnight. Its data did.

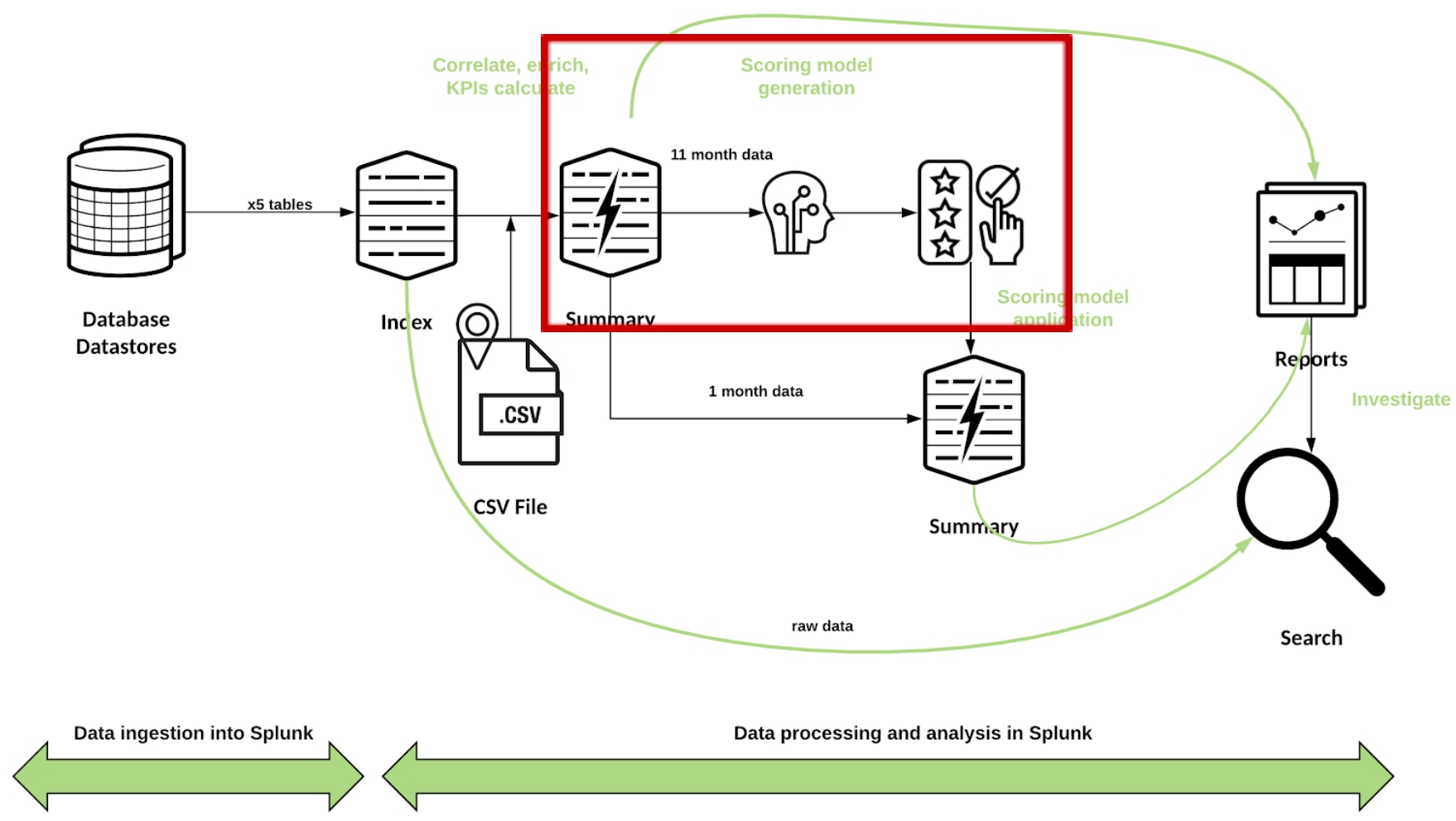

Case Study: Fraud Prevention

A digital payments platform experienced high chargeback rates. Manual analysts could not review incidents fast enough. The company deployed streaming analytics that scored every transaction in milliseconds.

Outputs included real time alerts, risk flags and automated account holds.

Losses declined dramatically and fraud investigations became proactive rather than reactive.

The Regulatory Dimension

Financial analytics must operate under strict compliance regimes. Banks must document how models are built, which variables they use and how outputs affect customers.

Regulators require

- Explainability

- Audit trails

- Bias controls

- Retention policies

- Breach reporting standards

Ignoring compliance leads to fines, withdrawal of licenses and reputational collapse. Analytics that are accurate but undocumented are a risk, not an asset.

Frequently Asked Questions

Is big data only useful for large financial institutions

No. Mid size banks and fintechs benefit faster because their systems change less frequently and scale more easily.

Does big data replace human analysts

No. Big data enhances analysts by providing context they cannot assemble manually.

Are risk models always accurate

No. They are accurate when fed high quality inputs and governed properly. Poor inputs produce unreliable predictions.

Conclusion

Big data is no longer an advantage in finance. It is the foundation of survival. Institutions that use data to predict risk operate with confidence. Those that rely on instinct invite loss. Analytics makes uncertainty measurable and transforms financial decisions into systems of probability.

Call to Action

Build risk prediction ecosystems designed for financial performance. Start at

https://dataguruanalytics.org/data-infrastructure-consulting and position your institution ahead of market uncertainty.